Town of Windsor Locks Assessor's Office

50 Church St, Windsor Locks, CT 06096

Phone: (860) 627-1448

Email: [email protected]

Assessor

John Creed, CCMA I

Deputy Assessor

AUBREY PAUL

Assessor Clerk

-

| Monday - Wednesday | 8:00 am - 4:00 pm |

| Thursday | 8:00 am - 6:00 pm |

| Friday | 8:00 am - 1:00 pm |

ANNOUNCEMENTS:

100% Permanent & Total Service Connected Disabled Veterans

An application must be filed annually. To receive the benefit for the 2025 Grand List Years and moving forward an updated VA disability letter must be filed along with this application by January 1st annually.

Please note that reminder letters will not be sent out.

If an application is not received by end of business day January 1st, it is a forfeiture of the benefit for that specific year.

Below please find a link to the application (which can also be found lower on our webpage in the "Tax Relief" section).

100% Permanent & Total Service connected Disabled Veteran Application Link

Posted 10/08/2025

The 2024 Assessment year runs October 2024 to September 2025

2025 GRAND LIST MILL RATE - TBD

2024 GRAND LIST MILL RATE - 23.99

2023 GRAND LIST MILL RATE - 28.14

2022 GRAND LIST MILL RATE - 26.33

2021 GRAND LIST MILL RATE - 25.83

Online Property Record Card Search

Equality Online Property Record Cards

Online GIS Mapping Search

Online GIS Maps

*Please note this site is under on going construction if you find incorrect data please contact our office at [email protected] for more information.

Real Estate

*Please note that the Town Of Winsor Locks was part of a bill that postponed our Revaluation until 2024.

The property record reflects the market value as of the last real estate revaluation, October 1, 2024, the assessment is 70% of the value.

Property owners are encouraged to review property data. Contact the Assessor’s Office concerning value, exemption questions, and record discrepancies.

*Please be aware, online information from other sources may be inaccurate.

If you would like further information about the Reval please visit the link below -

https://windsorlocksct.org/2024-reval/

Income & Expense Forms

Rental Property, Commercial, Industrial, Vacant Land & Public Utility

RETURN TO ASSESSOR ON OR BEFORE JUNE 1, 2026 *Effective July 1, 2023 Public Act 23-152 - "(e) Any income and expense disclosure form described in subsection (a) of this section received by the assessor to which such form is due that is in an envelope bearing a postmark, as defined in section 1-2a, showing a date within the allowed filing period, shall not be deemed delinquent."

- Income & Expense Form

- Income & Expense Form for Parking

- Income & Expense Form for Hotels & Motels

- Income & Expense Form for Skilled Nursing Facility

- Income & Expense Form for Cell Towers

Business / Personal Property

Our Business Personal Property filing period runs from October 1st, 2026 - November 1, 2026. All declarations must be in office by close of business November , 2026 to be considered on time. The only exception to this is if the declaration is being mailed into our office. If this is the case the postmark from the post office (not a postage meter in your office) must state November 1, 2026 at the latest. These same rules apply for any exemption forms that would be filed.

If you file online the portal is open October 1, 2026 - November 1, 2026. If your declaration is not submitted online during this time period you will need to file a paper copy with our office.

- 2024 Grand List Business Personal Property Listing by DBA

- 2024 Grand List Business Personal Property Listing by Unique ID

- Personal Property Q&A

- Personal Property Brochure

- Personal Property Powerpoint

- Personal Property info via CAAO

- Blank declarations:

- Personal Property Declare Online - 2026 ONLINE FILING STARTING 10/01/2026 AND AVAILABLE UNTIL 11/01/2026

- Personal Property Extension Request

- M-65 - Manufacturing Machinery and Equipment Exemption Claim

- Affidavit of Business Termination or Move or Sale of Business or Property

Motor Vehicles

Vehicles registered in Windsor Locks as of October 1st are assessed at 70% of the NADA New England Retail Value. The tax is distributed in July.

Vehicles registered in Windsor Locks after October 1st are assessed at 70% of the NADA New England Retail Value. The tax is distributed in January.

*PLEASE NOTE*

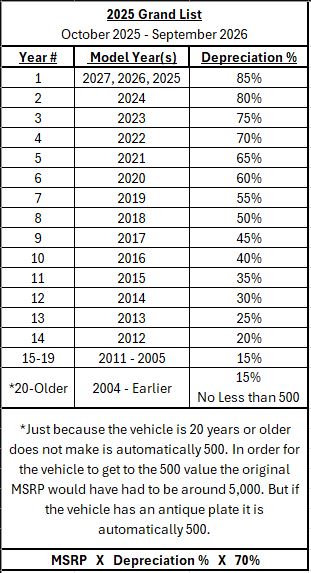

For the 2024 Grand List and moving forward the way that Motor Vehicles are valued will be changing.

The NADA New England Retail Value will no longer be used. The MSRP of the vehicle given by Price Digest multiplied by a depreciation percent established by the Connecticut Legislators for the year of your vehicle will give the value of the vehicle. That value is then multiplied by 70% to get the assessed value that you are taxed on.

Below is the depreciation amount per year that the legislation established.

EX.

2018 Model Year MSRP = 20,000

20,000 X .50 X .70 = 7,000 Assessed

2005 Model Year MSRP = 10,000

10,000 X .15 X .70 = 1,050 Assessed

1995 Model Year MSRP = 3,000

3,000 X .15 X .70 = 315 Assessed ------ *500 Assessed

*The value of the vehicle that was over 20 years old was under the minimum of 500 so the value reverts to 500.*

- Vehicle Q&A Brochure

- How to Remove / Adjust a Motor Vehicle Tax Bill

- Active Duty Exemption (AOA) form - DUE BY 12/31/2026 (Applicable for the 2025 Grand List)

- CT DMV Online Services

- CT DMV Change of Address

- CT DMV Cancel Registration and License Plate

- CT DMV Look Up Registration Status

- CT DMV Change of Address

Tax Relief

- Active Military & Veterans - Due annually by the December the bill is due

- Veterans Benefits

- 100% Permanently & Totally Service Connected Disabled Veteran Application - Due annually by January 1st

- Blind - Due by October 1

- Totally Disabled

- Elderly & Disabled Homeowner Brochure

- Elderly & Totally Disabled Homeowner Program - Next application period is February 1, 2026 - May 15, 2026. Please call our office during that time period to set up an appointment.

- PA-490 Guide

- Tax Exempt Organization Claim Form - Quadrennial - DUE BY 11/01/2026

- Ambulance - Type Motor Vehicle Exemption Application - DUE BY 11/01/2026

- M-55 Distressed Municipalities Annual Renewal Certificate - DUE BY 11/01/2026

Board of Assessment Appeal (BAA)

Board of Assessment Appeal website - https://windsorlocksct.org/board-of-assessment-appeals/

Board of Assessment Appeals Email - [email protected]

March Board of Assessment Appeals Meetings

According to Connecticut State Statute §12-111, for an appeal to be considered, and in order to be heard by

the Board of Assessment Appeals, at its March meeting, you MUST file a written appeal no later than February 20th to the Assessor’s Office. Unless the Assessor’s office is on extension for the Grand List which pushes the appeals deadline back to March 20th and all meetings will be held in April. March meetings are for Real Estate, Motor Vehicles, and Personal Property. All applicants and owners (or appointed agent) will be notified of the date and time of the hearing. If you are submitting an appraisal or other similar evidence, you must submit a copy along with your application. Once you have made application to the BAA, you will be notified where and when to appear for your hearing.

September Board of Assessment Appeals Meetings

The BAA will advertise the date of its September meeting in a local newspaper and on the Town’s web

site. The September meeting is for Motor Vehicles only. Taxpayers should appear with their vehicle and/or any evidence or documentation to support their claim. Applications are recommended for scheduling in September but are not mandated.

*Please note Assessment Appeals applications must be in by close of business day!

Board of Assessment Appeal Application

Meeting Dates:

March 12, 2026 Starting @ 6:00pm

March 19, 2026 Starting @ 6:00pm

| MILL RATE HISTORY | |||

| FISCAL YR | GRAND LIST | MILL RATE | NOTES |

| 2007-2008 | 2006 | 22.65 | |

| 2008-2009 | 2007 | 22.88 | |

| 2009-2010 | 2008 | 21.65 | RE-VALUATION YEAR |

| 2010-2011 | 2009 | 23.15 | |

| 2011-2012 | 2010 | 23.4 | |

| 2012-2013 | 2011 | 24.27 | |

| 2013-2014 | 2012 | 24.54 | |

| 2014-2015 | 2013 | 26.23 | RE-VALUATION YEAR |

| 2015-2016 | 2014 | 26.79 | |

| 2016-2017 | 2015 | 26.66 | |

| 2017-2018 | 2016 | 26.66 | |

| 2018-2019 | 2017 | 26.66 | |

| 2019-2020 | 2018 | 25.83 | RE-VALUATION YEAR |

| 2020-2021 | 2019 | 25.83 | |

| 2021-2022 | 2020 | 25.83 | |

| 2022-2023 | 2021 | 25.83 | |

| 2023-2024 | 2022 | 26.33 | |

| 2024-2025 | 2023 | 28.14 | |

| 2025-2026 | 2024 | 23.99 | RE-VALUATION YEAR |

| 2026-2027 | 2025 | TBD | |

| --------------- | ---------------- | ------------ | |

| AVG HOME VALUE | ASSESSED 70% | TAX | |

| $186,770 | $130,740 | $3,377 | |

| --------------- | ----------------- | ------------ | |

| AVG CAR VALUE | ASSESSED 70% | TAX | |

| $25,000 | $17,500 | $452 | |